2019 Policy With Blue Cross Blue Shield and Medicare Does It Pay for Dental Work

NOTE: A newer version of this analysis is available here. Due to a information collection and processing event identified by CMS, the estimates for private dental coverage derived from the 2016 Medicare Current Beneficiary Survey (MCBS) were lower than they should take been by an unknown magnitude. Every bit a issue, the estimate of how many beneficiaries lack dental coverage (65%) should not be used. It is not possible to calculate a correct estimate for that twelvemonth due to the MCBS data collection issue. CMS resolved this issue in 2017. Due to this and other methodological changes in our analysis, estimates of the number of people on Medicare with dental insurance cannot be trended using our 2016 guess. Please encounter the methodology here for more data.

Oral health is an integral part of overall health, but its importance to overall wellness and well-being often goes unrecognized.1 Untreated oral health problems can pb to serious wellness complications. Having no natural teeth can cause nutritional deficiencies and related health problems.2 Untreated caries (cavities) and periodontal (gum) illness can exacerbate certain diseases, such as diabetes and cardiovascular affliction, and lead to chronic pain, infections, and loss of teeth.3 Lack of routine dental care can also delay diagnosis of conditions, which tin atomic number 82 to potentially preventable complications, loftier-cost emergency section visits, and agin outcomes.

Medicare, the national health insurance program for about 60 million older adults and younger beneficiaries with disabilities, does non embrace routine dental care, and the majority of people on Medicare have no dental coverage at all. Limited or no dental insurance coverage tin issue in relatively loftier out-of-pocket costs for some and foregone oral health care for others. This brief reviews the country of oral wellness for people on Medicare. Information technology describes the consequences of foregoing dental intendance, electric current sources of dental coverage, employ of dental services, and related out-of-pocket spending.

Key Findings

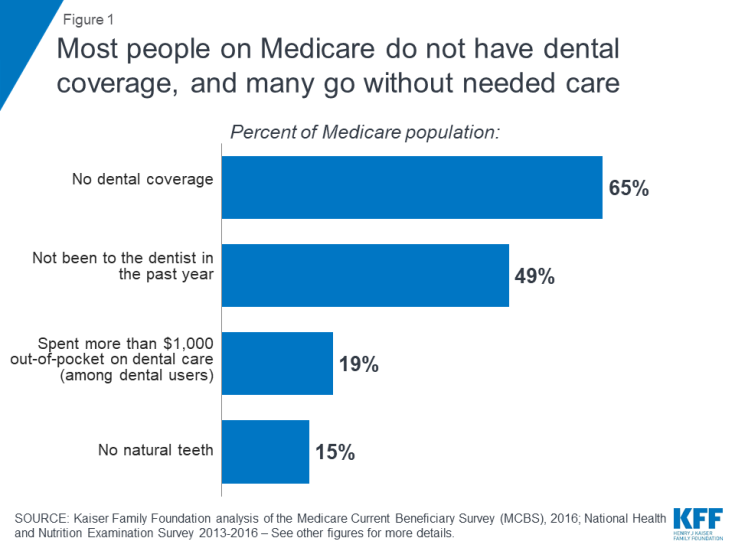

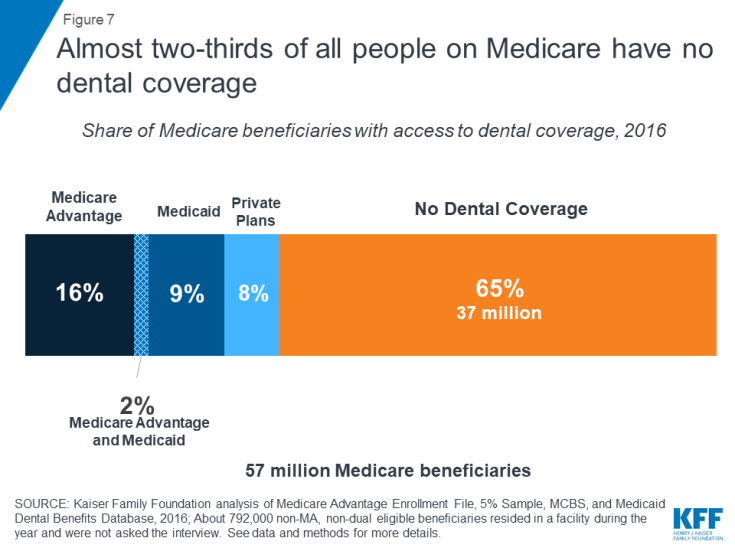

- Near two-thirds of Medicare beneficiaries (65%), or nearly 37 meg people, do not have dental coverage (Figure 1).

Figure 1: Almost people on Medicare exercise not have dental coverage, and many go without needed care

- Well-nigh one-half of all Medicare beneficiaries did not take a dental visit within the past twelvemonth (49%), with higher rates amongst those who are blackness (71%) or Hispanic (65%), have low incomes (70%), and are living in rural areas (59%), as of 2016.4

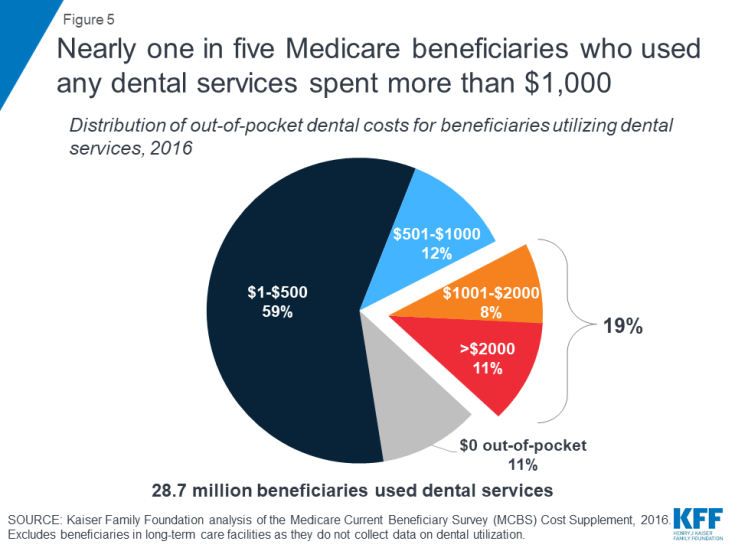

- Well-nigh one in 5 Medicare beneficiaries (19%) who used dental services spent more $1,000 out-of-pocket on dental care in 2016.

The Wellness and Economic Consequences of Unmet Demand

Numerous studies confirm the direct connectedness between oral wellness and overall health.5 , vi Oral health is oftentimes a reflection of the overall health of the trunk.vii Oral wellness examinations tin place nutritional deficiencies, HIV, sure microbial infections, and some cancers.8 , 9 In addition to reflecting underlying illness, poor oral health tin exacerbate general wellness bug and systemic diseases. Periodontal disease, or advanced gum disease, is associated with increased adventure of cardiovascular diseases, including arteriosclerosis, coronary center disease, and stroke,10 , 11 , 12 increased adventure of mortality for those with chronic kidney disease,13 adverse pregnancy outcomes,14 increased risk of cancer,fifteen , xvi and poor glycemic control for diabetes.17 , 18 The chronic systemic inflammation and dysbiosis (bacterial imbalances in the mouth) that are characteristic of periodontal disease can exacerbate these conditions. For instance, inflammation and dysbiosis may generate immune responses that increase the risk of cancer as well as contribute to insulin resistance that makes diabetes management more difficult.19 , 20 , 21

Oral health issues pose particular concerns for older adults. For instance, xerostomia (dry oral fissure) is a side upshot for hundreds of medications. Dry out rima oris significantly increases the gamble of dental caries, loosening dentures that can lead to painful ulcerations, difficulty chewing or swallowing and altered taste, which can negatively bear upon nutrition, as well as a series of other oral health issues such as recurrent oral thrush and lesions on the oral mucosa.22 Incidence of dry mouth increases with the number of medications used, and is a particular business for seniors: 54 percent of adults age 65 and older accept at least four prescription drugs.23 , 24 , 25

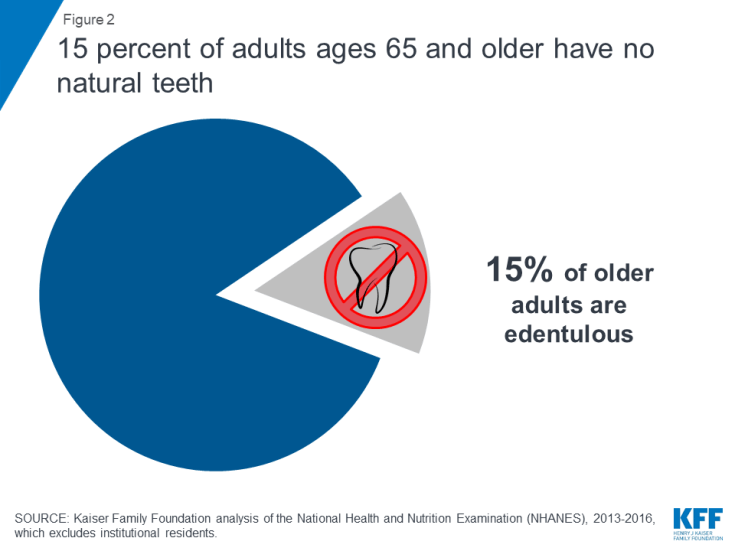

Among adults 65 and older residing in the community, 15 per centum are edentulous, meaning they have no natural teeth (Effigy 2).26 The share of older adults without natural teeth increases with age, from 12 percent among those 65 to 74 years old to 20 percent for 75 to 80 year olds. Edentulism is likewise more common among seniors with low incomes. While edentulism amidst all older adults has declined over fourth dimension, the greatest declines take been among primarily high income populations.27 For example, virtually one in 3 of those with incomes below 100% of the federal poverty level (xxx%) accept no natural teeth, a rate five times higher than those with incomes over 400% of the federal level (6%).28 There is besides significant geographic variation in the number of older adults without teeth. For case, more than than 30 percent of seniors in West Virginia have no natural teeth, compared to less than 10 percentage in states such every bit California and Connecticut.29

Figure 2: 15 percent of adults ages 65 and older accept no natural teeth

Having no or few teeth can adversely impact quality of life. Many older adults study being embarrassed about their teeth, avoid smile, and fifty-fifty reduce social participation due the condition of their mouth and teeth.thirty Furthermore, having no or few teeth can brand chewing and eating difficult and can lead to additional health complications. Among all Medicare beneficiaries living in the community, 18 per centum have some difficulty chewing and eating solid foods due to their teeth – a rate that rises to 29 percentage for those with low incomes and 33 pct for adults with disabilities on Medicare who are under age 65.31 Tooth loss as well affects diet because people without teeth are more likely to substitute easier to chew foods that are loftier in saturated fat and cholesterol for fruits and vegetables which are harder to chew.32 , 33

Older adults also have loftier rates of untreated caries and periodontal disease, which negatively affect oral and overall health: more than fourteen percent of older adults have untreated caries34 and about 2 in three (68%) have periodontal disease.35 If left untreated, caries and periodontal disease can atomic number 82 to infections, abscesses, tooth loss, and chronic pain.36 Many older adults report having frequent painful aching in their mouths, with 15 per centum having painful agonized at to the lowest degree occasionally.37

Poor oral wellness is associated with potentially preventable and costly emergency section (ED) visits, with more than 2 million visits to the ED each yr among people of all ages due to oral wellness complications.38 Many dental-related ED visits are for potentially avoidable, non-traumatic dental conditions and could exist treated in a principal care setting.39 , 40 Yet, further enquiry is needed that focuses specifically on the Medicare population and their use of EDs for dental-related issues, including how lack of dental coverage may impact potentially preventable ED utilise.

Many People on Medicare Forego Non-Emergency Dental Care

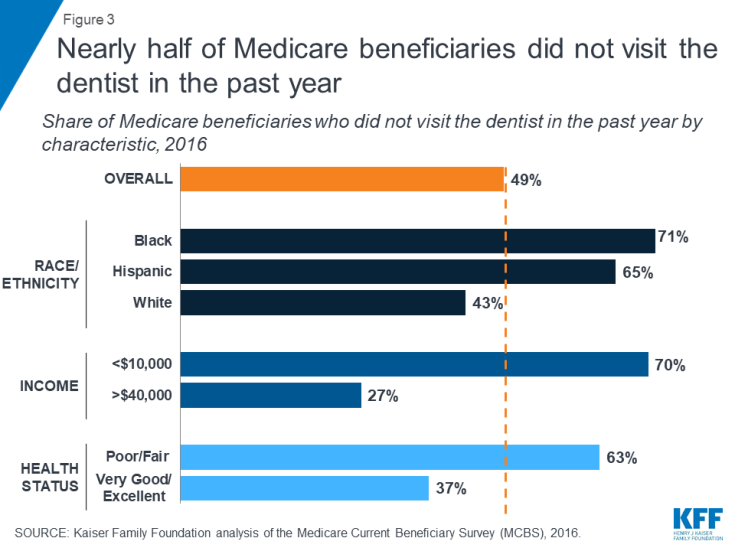

A relatively big share of people on Medicare go without needed dental care. The American Dental Association recommends at to the lowest degree one annual visit per year, but suggests more than frequent visits depending on the wellness status and dental needs of private patients.41 Nevertheless, about half of all Medicare beneficiaries did not have a dental visit in 2016 (49%) – with even higher rates reported among those who are black or Hispanic, take low incomes, are in relatively poor wellness, and live in rural areas (Figure iii).

Figure 3: Most half of Medicare beneficiaries did not visit the dentist in the past yr

- In 2016, more than seven in ten black beneficiaries (71%) and well-nigh two in three Hispanic beneficiaries (65%) went without a dental visit in the past twelvemonth, compared to 43 pct of white beneficiaries;

- Vii in x beneficiaries living on incomes of less than $ten,000 per yr (70%) reported not going to the dentist within the past yr, compared to 27 percent of beneficiaries with incomes over $40,000 per year;

- More than than half-dozen in ten beneficiaries in self-reported fair or poor health did non go to the dentist in the by year (63%), as compared to 37 percent of beneficiaries in excellent or very good health;

- More than half-dozen in ten beneficiaries younger than 65 with disabilities (62%) went without a dental visit in the past year; and

- Near six in ten (59%) beneficiaries living in rural areas did not meet a dentist in the past yr, compared to 46 percent of beneficiaries living in metropolitan areas.

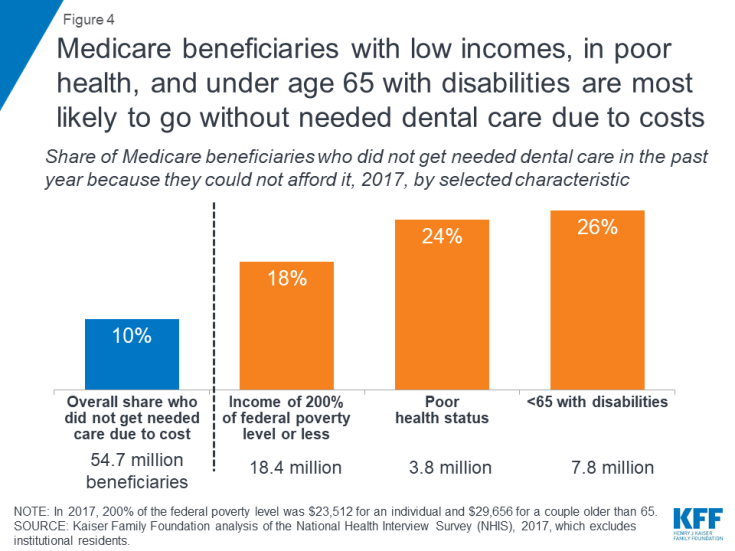

Many Medicare beneficiaries get without dental intendance due to costs. Overall, ten per centum of all beneficiaries did not go needed dental care in the by year because they could not afford information technology (Figure 4). The rate was higher among those with low incomes (18%), those in relatively poor health (24%), and beneficiaries under 65 with long-term disabilities (26%). While cost is oft cited as meridian reason for not going to the dentist among those who said they needed care but did not get, fear of the dentist, inconvenient location or fourth dimension for an appointment are as well important contributing factors.42

Figure iv: Medicare beneficiaries with low incomes, in poor health, and nether historic period 65 with disabilities are most likely to go without needed dental care due to costs

Older adults also encounter additional challenges accessing oral health care, including dental health professional shortages, transportation challenges, and health literacy problems. Approximately 46 meg people of all ages live in dental wellness professional shortage areas, 66 percent of which are considered rural.43 , 44 Many older adults and adults with disabilities cite transportation as an important barrier to accessing health care, which disproportionately affects sure populations, such equally those living in rural areas and those with low-incomes.45 Oral health literacy continues to be an upshot as many exercise not sympathize the importance of oral health, how to prevent oral health diseases, and how to obtain dental care.46

Beneficiaries with Significant Dental Needs May Incur Loftier Out-of-Pocket Costs, If They Seek Treatment

The vast majority (89%) of beneficiaries who received dental services paid for some of their intendance out-of-pocket (Figure 5). Across all beneficiaries, boilerplate out-of-pocket spending on dental care was $469 in 2016, and among those who used any dental services, average out-of-pocket spending on dental intendance was $922. Almost i-5th of beneficiaries who used dental services (19%) spent more than $1,000 out-of-pocket on dental care. With half of Medicare beneficiaries living on less than $26,200 per year, this is a significant portion of their incomes.47 Merely a small percentage (11%) used dental services without incurring whatever out-of-pocket costs. Medicare beneficiaries who used dental services may or may not have had dental insurance, including dental coverage through Medicare Advantage, Medicaid, or individual plans.

Figure 5: Nearly 1 in five Medicare beneficiaries who used whatsoever dental services spent more than $1,000

As might be expected, boilerplate out-of-pocket spending on dental intendance rises with income because higher income beneficiaries are more able to afford such expenses, not because they have greater dental needs. Conversely, lower income beneficiaries are more probable to forego needed dental intendance. Among dental users, one in 4 beneficiaries (25%) living on incomes of less than $10,000 per year spent more than $500 out-of-pocket per year on dental care. Among those living on $x,000-$xx,000 per yr, more than than 28 pct spent more than than $500 out-of-pocket on dental care. The share of beneficiaries spending more than $500 out-of-pocket on dental care rises to 29 percent for those living on $20,000-$40,000 per year to 34 percent for those living on more than than $40,000 per year.

Current Sources of Dental Coverage

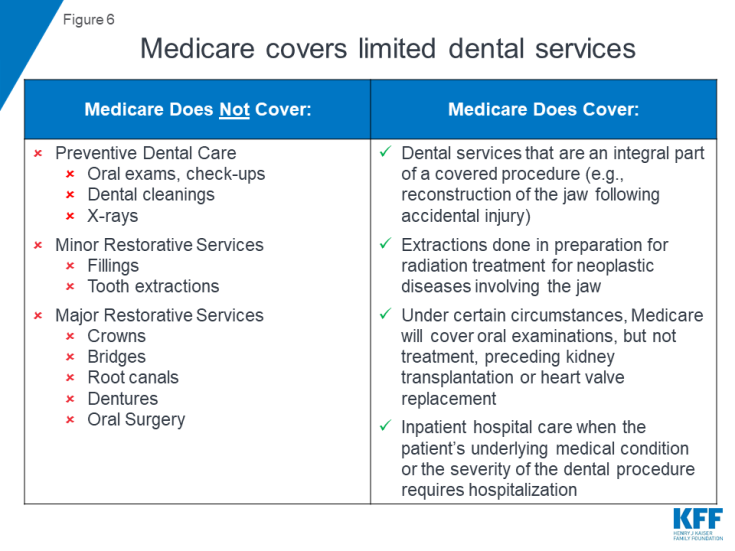

Since its establishment in 1965, Medicare has explicitly excluded coverage for dental services, except in very limited circumstances.48 Traditional Medicare does not cover routine preventive dental services (such as exams, cleanings, or 10-rays), nor small-scale and major restorative services (such as fillings, crowns, or dentures; Figure 6).

Figure 6: Medicare covers limited dental services

Medicare coverage is limited to dental services that are an integral part of a covered procedure, extractions done in preparation for radiations treatment for cancers involving the jaw, and oral examinations (but not treatment) preceding kidney transplants or heart valve replacements.49 Medicare likewise covers hospital intendance (such as emergency department visits) resulting from complications of a dental procedure, simply does not comprehend the cost of the dental care itself.l Current coverage policy for dental care is not completely articulate or consistent, and the Medicare program is reviewing its dominance to provide additional services.51

Nearly 37 million people, or almost two in iii Medicare beneficiaries (65%), do not accept any form of dental coverage (Effigy seven). Beneficiaries without whatsoever form of dental coverage are more likely than others to go without needed dental care, unless they tin afford to comprehend the costs out-of-pocket.52 , 53

Figure 7: Almost two-thirds of all people on Medicare have no dental coverage

The remaining Medicare beneficiaries have access to dental coverage through Medicare Advantage plans, Medicaid, and individual plans, including employer-sponsored retiree plans and individually purchased plans. In 2016, near 10.2 meg beneficiaries (18%) had access to some dental coverage through Medicare Advantage (including approximately one.2 million enrollees who also have admission to dental coverage through Medicaid). An estimated 6.2 1000000 low-income Medicare beneficiaries (11%) had admission to dental coverage through Medicaid (including the aforementioned who also have coverage through Medicare Advantage plans), and 4.v meg (8%) had coverage through private plans.

Telescopic of Coverage

The telescopic of dental coverage and affordability of dental care is an result for people of all ages. Private dental insurance plans, primarily for working-age adults, vary in terms of benefits and cost-sharing, but typically provide limited coverage for high-toll treatments. Individual dental insurance tends to cover near, if not all costs, associated with preventive services, but has less generous coverage for more than expensive services, exposing patients to high out-of-pocket costs for needed dental intendance. For instance, in these private dental plans, preventive care is by and large 100% covered, while co-insurance for minor and major restorative services often ranges from xx-40% for basic procedures and up to 50% or more for major procedures.54 Further, individual dental plans ofttimes impose an annual dollar cap on the corporeality the plan will pay toward covered services, with a median cap of virtually $ane,500.55 Thus, even with dental insurance, people of all ages tin can face up high out-of-pocket costs for dental treatments, an issue that likewise affects people on Medicare.

In the following sections, we review electric current sources of dental coverage that may exist available to people on Medicare, including Medicare Advantage, Medicaid, and private dental plans (employer-sponsored retiree and individually purchased).

MEDICARE ADVANTAGE

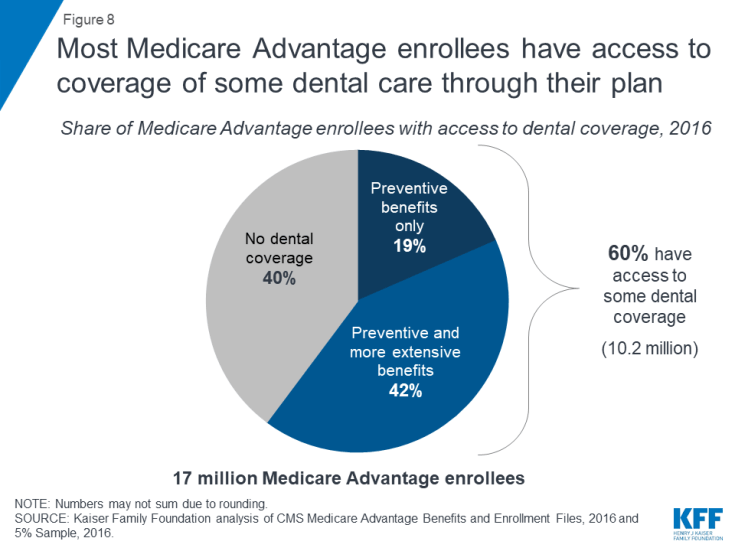

Many Medicare Advantage plans provide access to dental coverage as a supplemental, non-Medicare covered benefit.56 In 2016, lx percentage of Medicare Advantage enrollees, or about 10.2 million beneficiaries, had admission to some dental coverage (Figure 8).57 The remaining forty percent of all Medicare Advantage enrollees, or virtually vii meg beneficiaries, did not have access to dental coverage under their program.

Effigy 8: Most Medicare Advantage enrollees have admission to coverage of some dental care through their plan

Nearly four in ten (42%) Medicare Advantage enrollees had admission to both preventive and more extensive dental benefits, while about one in 5 (19%) had admission to preventive dental benefits only, which would exclude coverage of benefits many older adults need such as fillings, crowns, implants and dentures.58 Preventive dental coverage under Medicare Advantage plans generally includes oral exams, cleanings, fluoride treatments, and dental x-rays.

Additional Premiums for Dental Coverage. Some Medicare Advantage plans charge an additional premium for dental benefits, and enrollees must pay that premium in order to receive the dental coverage. No data are available about how many people take upwardly this option when a premium is required. Overall, almost three in 10 (29%) Medicare Advantage enrollees with access to dental benefits under their plan may be required to pay a monthly premium, averaging $284 per year in 2016, for the program dental benefits. Premiums are more common in plans that offer coverage beyond preventive dental coverage: well-nigh four in ten (38%) enrollees in plans that offered both extensive and preventive dental coverage may exist required to pay a premium for that coverage, compared to less than one in x enrollees (8%) in plans that provided but preventive coverage. Premiums for Medicare Advantage dental benefits in 2016 ranged from about $72 per year to more than $720 per twelvemonth. Dental premiums are in addition to premiums for other Medicare Advantage benefits, as well equally the Medicare Role B premium.

Cost-Sharing. Medicare Advantage plans' cost-sharing for dental benefits varies widely from program-to-plan and across counties. Some plans require no cost-sharing for preventive services but charge a monthly premium, while other plans require enrollees to pay a apartment co-pay (e.g., $5) for each preventive service. Similarly, for relatively all-encompassing benefits, some plans encompass nigh of the cost of some benefits (e.thou., dentures) and others charge a apartment coinsurance rate (e.k., 50%) for all services. Plans charge coinsurance rates that often range profoundly – from 20-lxx% – and some plans crave flat copayments instead of coinsurance.59

Annual Caps on Coverage and Service Limits. Medicare Advantage plans that offer access to preventive and more all-encompassing dental benefits commonly cap the total amount the programme will pay for dental care. Of the 7 meg Medicare Advantage enrollees in plans that offered both preventive and more extensive dental benefits, nigh four in ten (43%) are in plans with dollar limits on coverage, and nigh plans had limits around $1,000.60 Coverage limits are far more common among plans that comprehend both preventive and more extensive benefits than plans that embrace just preventive services. In add-on to dollar limits, Medicare Advantage plans typically limit the number of services covered (e.yard., one periodontal exam every three years).

MEDICAID

Medicaid is a source of dental coverage for some low-income Medicare beneficiaries dually eligible for Medicaid (known every bit "dual eligibles"), just only in the states that elect to provide a dental benefit to adults. In 2016, approximately 10 million Medicare beneficiaries qualified for Medicaid, with 7 million qualifying as total dual eligibles and 3 million as partial dual eligibles.61 Full dual eligibles are mostly eligible to receive total Medicaid benefits, such as dental, when it is covered past that country, whereas partial dual eligibles more often than not receive assistance from Medicaid with Medicare premiums and/or toll-sharing, but not other benefits. Land Medicaid programs are not required to cover dental benefits for adults because it is an optional benefit, and can choose to provide the benefit to some just not all dual eligibles.

Among full dual eligibles, almost nine in x (88%) lived in a state where they were eligible for some dental benefits from Medicaid.62 Yet, the range in covered benefits varies significantly across states. For example, some states only offer preventive benefits, such as Kansas, Maine, and Due north Dakota, which allow a express number of exams and cleanings per year. A number of states offer more extensive coverage, only take almanac dollar caps on benefits and may require prior authorization for certain procedures. There also some states, such as Georgia and Oklahoma, which limit coverage to emergency dental visits only. States that offer emergency-only benefits may not provide much additional coverage than what is currently covered past traditional Medicare. About 1-tenth of dual eligibles (12%), or 800,000 people, resided in the 6 states that provided no dental coverage through Medicaid in 2016 (Alabama, Delaware, Maryland, Tennessee, Texas, Virginia).

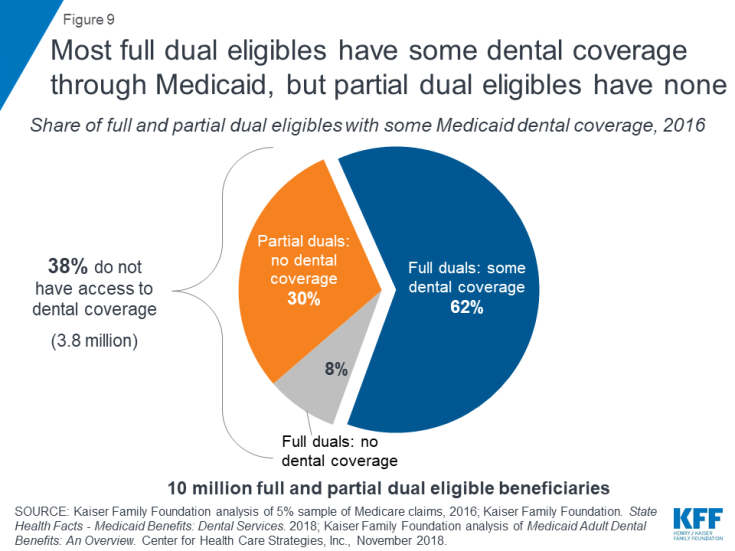

In addition to the 800,000 total dual eligibles who do not have dental coverage through Medicaid, another three million partial dual eligibles do not have Medicaid dental coverage because they are not eligible for Medicaid-covered benefits. Overall, 3.8 million low-income people who authorize for Medicaid did non take dental coverage through Medicaid in 2016 (Effigy 9).

Figure 9: Most full dual eligibles have some dental coverage through Medicaid, but partial dual eligibles have none

Land dental benefits can modify over fourth dimension, particularly in response to budget pressures, since dental coverage for adults is an optional Medicaid benefit. For example, in California, adult dental benefits were cutting in 2009 due to budget constraints, partially restored in 2014, and fully restored in 2018.63 , 64 In 2018 and 2019, ii states (California, Illinois) enhanced or added dental benefits for all adults, while iii states enhanced benefits for certain adult populations (Arizona'due south applies to Non-Long Term Services and Supports (LTSS) adults, Utah'due south applies to but those with disabilities, and Maryland's applies only to full dual eligibles). Six states (Alaska, Connecticut, Iowa, Kentucky, Oklahoma, Nevada) restricted adult dental benefits.65

Overlap of Dental Coverage for Dual Eligibles

Some beneficiaries covered by both Medicare and Medicaid are also able to access dental care through Medicare Advantage plans. In total, approximately 2.4 million full and partial dual eligibles (1.iv million total dual eligibles and ane.0 one thousand thousand partial dual eligibles) were enrolled in Medicare Advantage plans that provided access to dental coverage in 2016.66 Yet, premiums and cost-sharing for dental benefits may even so present a significant hurdle and may make the coverage unaffordable, particularly if Medicaid does not cover these costs. About ane in 10 (eleven%) dual eligibles were in plans that charged an additional premium for dental coverage, which would be in addition to any cost-sharing for the dental intendance.

About 1.2 one thousand thousand full dual eligibles lived in states that offer some dental coverage through Medicaid and were enrolled in Medicare Reward plans that offering access to some dental coverage. While these beneficiaries have more than 1 option for dental coverage, analogous Medicaid dental coverage and dental coverage through Medicare Reward plans, and specifically, figuring out the circumstances under which each coverage option would pay for particular services, can exist especially complicated and murky.

PRIVATE INSURANCE

Medicare beneficiaries may as well receive dental benefits through individual plans such as employer-sponsored retiree plans or through individually purchased plans. In 2016, well-nigh four.v million Medicare beneficiaries received dental coverage through individual plans.67

Unfortunately, data describing dental coverage nether employer-sponsored retiree and individually purchased plans for people on Medicare are express. For example, nearly 10 meg beneficiaries in traditional Medicare had employer-sponsored retiree insurance.68 Even so, there are no known data sources that convey how many of these plans cover dental benefits, or the level of dental coverage these plans provide.

Medicare beneficiaries can buy individual dental policies directly through companies such equally DeltaDental, United Healthcare, Cigna, and BlueCross BlueShield. These plans vary in terms of premiums, covered benefits, price-sharing requirements, almanac service limits, and almanac benefit caps. Based upon company websites, annual caps appear to be similar to those offered by Medicare Advantage plans.

Older Adults Can Incur Substantial Out-of-Pocket Costs for Dental Intendance, Even with Insurance: Three Scenarios

Even with dental insurance, older adults tin can face up substantial out-of-pocket costs for their dental intendance. While the scope of dental coverage varies, it is often the case that out-of-pocket costs may be relatively low for people who simply need routine check-ups and cleanings. Yet, people who need more than extensive oral health services tin incur relatively high costs for their dental care, on tiptop of premiums and other out-of-pocket medical expenses, due to coinsurance requirements and almanac caps.

We adult the following scenarios, with input from oral health experts, to demonstrate the range in potential costs older adults may face up for common dental services, based on fees obtained from the American Dental Association (ADA) 2018 Survey of Dental Fees. The scenarios, based on national, median fees, are designed to exist illustrative, recognizing that fees vary past a number of factors, including geography and the negotiated rates established between dentists and insurers. (Encounter Table 4 for a detailed clarification of services and fees for each of the three scenarios.)

Scenario ane: Linda, age 67, is in excellent wellness and visits her dentist regularly. In a typical year, such as last year, Linda has one dental visit with an oral exam, cleaning, and 10-rays, and a follow-up test and cleaning six months later.

Without dental coverage, the total cost of Linda's procedures would be virtually $350, based on national median fees derived from the 2018 ADA survey of dental fees. If Linda had coverage through a private, dental insurance program – either a dental program that she purchased directly or through a Medicare Advantage plan – her out-of-pocket costs would be relatively low because dental insurance oftentimes covers a big portion of preventive dental costs. Even if her dental plan capped annual benefits, as many do, she would accept express expenses considering annual caps are typically not less than $500. Linda could have paid a premium for her Medicare Advantage dental plan and premiums are on average $284 per year,69 varying based on the extent of coverage and other factors.

If Linda had coverage under both Medicare and Medicaid (dually eligible) and lived in a state that covered adult dental through Medicaid, she would almost likely have express, if whatever expenses, if she were able to find a dentist who treats Medicaid patients and lived in a state that covers more than than one preventive visit per twelvemonth.

Scenario ii: James, historic period 72, went to the dentist later realizing he hadn't had an oral exam in shut to two years. After what he hoped would be a routine check-up and cleaning, his dentist said he would need periodontal handling, iii fillings, and 2 crowns due to degradation of restorations. Later receiving these restorative services, he returned six months after for a regular check-up where he received periodontal maintenance.

Without dental coverage, the total cost of James' visits would be an estimated $4,300. If James had dental coverage through a individual plan or Medicare Reward, his costs would be lower, but he would notwithstanding likely incur substantial costs. Some Medicare Advantage plans, for instance, cover only preventive services, which would leave him with the biggest expenses to pay for on his own. Others cover both preventive and more extensive dental care, but crave relatively high coinsurance for the virtually expensive procedures, and often with caps on the annual amount paid by the plan. Medicare Advantage plans often accuse coinsurance, which ranges from xx%-70% depending on the type of service.seventy If James had signed up for a Medicare Advantage plan, with dental coverage that included a common cap of $i,000, he would be responsible for all charges higher up the cap, or every bit much every bit $3,300.

If James qualified for Medicaid, he could potentially get some help with these expenses, if he lived in a land that covers both preventive and more extensive dental services for older adults.

Scenario iii: Dorothy, age eighty, has diabetes, heart disease, and arthritis, and takes multiple medications to manage her medical conditions, some of which cause dry rima oris. Considering she was more focused on her other wellness problems, she had not been to a dentist in three years. Last year, she went to run into a dentist at the suggestion of her physician later on she complained of a dull throbbing pain in her lower left jaw. After a comprehensive exam and x-rays, her dentist told her that she needed a root culvert and crown, and would demand to have four upper teeth extracted. Her dentist recommended two implants to replace the extracted teeth, merely when she heard what that would toll, she opted instead for a fractional upper denture.

Without dental coverage, Dorothy's dental pecker would be about $4,700, assuming she opted for the less expensive removable partial denture, simply closer to $10,000 for 2 implants, if not more, since the estimated costs of the implants exclude fees for the concluding restorations.71

If Dorothy had coverage through a private plan or Medicare Reward plan, her costs would be somewhat lower, but by how much would depend on the specific features of her dental plan. With a more extensive plan, she may or may not accept coverage for specific services, such as dentures, which is a substantial portion of her bill. Plans typically require coinsurance for these procedures, significant she would still take to pay a meaning corporeality out of pocket for her care. Plans frequently have caps on coverage, which means Dorothy would be responsible for all costs higher up her limit, which would be close to $four,000 in a plan with a $1,000 almanac cap, or shut to $ix,000 if she had chosen the implants, or possibly less if the program negotiated lower rates.

If Dorothy qualified for Medicaid, she could get some coverage if she lived in one of united states of america that covers adult dental. Nonetheless, state annual caps and coverage of certain procedures vary, including for dentures, then she nevertheless might pay a substantial corporeality of money out-of-pocket. Dorothy would besides need to brand a number of visits to the dentist for these procedures, which could be a barrier for many Medicare beneficiaries, specially those that face transportation challenges.

Discussion

Oral wellness is important to people of all ages, including older adults and younger Medicare beneficiaries with disabilities, but maintaining good oral health is often challenging. Medicare does not more often than not cover dental care, which tin can make dental procedures unaffordable. Some Medicare beneficiaries have access to dental coverage through Medicare Advantage plans, Medicaid, or private plans (employer-sponsored retiree or individually purchased policies), but, similar to private dental plans offered to working-age adults, coverage varies widely, is oft less generous for procedures beyond routine preventive care, and is frequently field of study to annual caps. Poor dental care and oral health lead to edentulism, untreated caries, and periodontal affliction, which contribute to agin health outcomes and loftier-cost preventable emergency room visits. These ongoing challenges enhance interest in finding ways to make dental intendance more than affordable and accessible for the Medicare population.

A broad array of policy options could exist considered to aggrandize dental coverage to people on Medicare. Some advocates believe that the Centers for Medicare and Medicaid Services (CMS) currently has the authorisation to cover oral health intendance when medically necessary for handling of Medicare-covered diseases, illnesses, and injuries, and at the request of members of Congress, the agency is reviewing this.72 , 73 Legislation that would have a broader scope is also under consideration. For instance, during the 115th and 116th Congresses, some take proposed hit the dental exclusion and including dental services as a covered benefit.74 Others accept considered a dissever, voluntary dental benefit, similar to the Part D prescription drug do good, with its own premium.75 An alternative approach could be to create a benefit exclusively for low-income beneficiaries, under Medicare or Medicaid. Each of these approaches would accept budget implications, and raises questions concerning scope of coverage, toll-sharing, provider fees and assistants. Thus far, the Congressional Budget Office has non estimated the toll of calculation a dental benefit to Medicare. Given the significant wellness risks associated with poor oral intendance and the costs and consequences of untreated dental needs, identifying potential solutions to improve the oral wellness status of the Medicare population remains a challenge.

Kendal Orgera, a Policy Analyst with the Kaiser Family Foundation, and Anthony Damico, an independent consultant, provided programming support for this brief. The cursory also benefited from the inquiry back up of Nadia Massad and Robbie Herman of the Howard Academy College of Dentistry, and comments from reviewers, including Cassandra Yarbrough and Marko Vujicic of the American Dental Association.

This brief was funded in part by the AARP Public Policy Found.

Source: https://www.kff.org/medicare/issue-brief/drilling-down-on-dental-coverage-and-costs-for-medicare-beneficiaries/

Post a Comment for "2019 Policy With Blue Cross Blue Shield and Medicare Does It Pay for Dental Work"